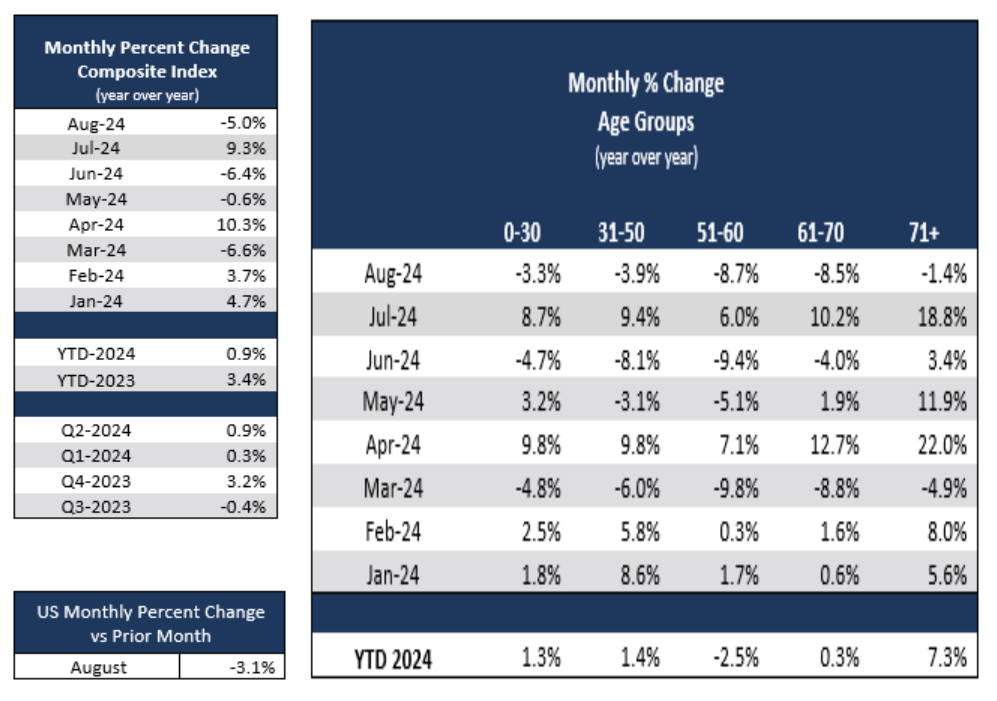

U.S. Life Insurance Application Activity Declines YOY in August 2024 and is Flat YTD

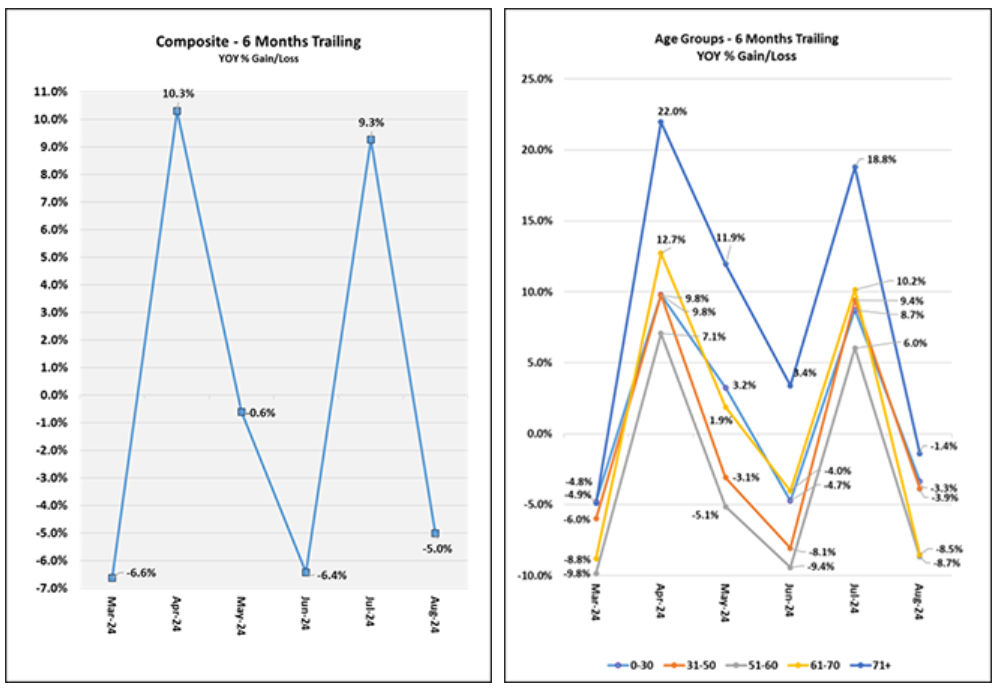

U.S. life insurance application activity saw declines in August 2024 compared to August 2023, with Year-over-Year (YOY) activity down -5.0%. On a Year-to Date (YTD) basis, activity through August 2024 was flat at +0.9% compared to August 2023. When comparing August 2024 to the same month in prior years, YTD activity was up +4.3% compared to 2022 and down -2.1% compared to 2021. On a Month-over Month (MOM) basis, August 2024 was down -3.1% compared to July 2024.

For August 2024 YOY, ages 71+ saw flat activity, while all other age bands saw declines. YOY activity for ages 0-30 was down -3.3%, ages 31-50 down -3.9%, ages 51-60 down -8.7%, ages 61-70 down -8.5%, and ages 71+ flat at -1.4%. On a Year-to-Date (YTD) basis, ages 71+ saw YOY growth, ages 51-60 saw declines, and other ages bands saw flat activity. August YTD activity for ages 0-30 was flat at +1.3%, ages 31-50 flat at +1.4%, ages 51-60 down -2.5%, ages 61-70 flat at +0.3%, and ages 71+ up +7.3%.

When examining YOY activity for August 2024 by face amounts, we saw growth for amounts over $250K up to and including $5M, in the double digits for amounts over $500K up to and including $2.5M, flat activity for amounts over $5M, and declines for amounts up to and including $250K. It is important to note when considering these trends that almost 60% of total application activity in August 2024 was for face amounts up to and including $250K. When including age bands, ages 0-30 saw growth for amounts over $250K up to and including $5M, in the double digits for amounts over $500K up to and including $1M, and declines for all other amounts, with double-digit declines for amounts over $5M. Ages 31-50 saw growth for amounts over $250K, in the double digits for amounts over $500K up to and including $2.5M, and declines for amounts up to and including $250K. Ages 51-60 saw growth for amounts over $250K up to and including $5M, in the double digits for amounts over $2.5M up to and including $5M, and declines for all other amounts, with double-digit declines for amounts over $5M. Ages 61-70 saw growth for amounts over $250K up to and including $500K and amounts over $1M, in the double digits for amounts over $1M up to and including $2.5M as well as for amounts over $5M, flat activity for amounts over $500K up to and including $1M, and declines for amounts up to and including $250K. Ages 71+ saw growth across all face amounts, in the double digits for amounts over $500K up to and including $1M as well as for amounts over $2.5M.

August 2024 saw YOY growth in Term Life, flat activity in Whole Life, and double-digit declines in Universal Life. Term Life was up +6.0% YOY, Whole Life was flat at +0.9%, and Universal Life was down -34.3%. Term Life saw YOY growth for ages 0-50, flat activity for ages 51-70, and double-dight declines for ages 71+. Whole Life saw growth for ages 61+, in the double digits for ages 71+, flat activity for ages 0-30, and declines for ages 31-60. Universal Life saw double-digit declines for all ages bands.